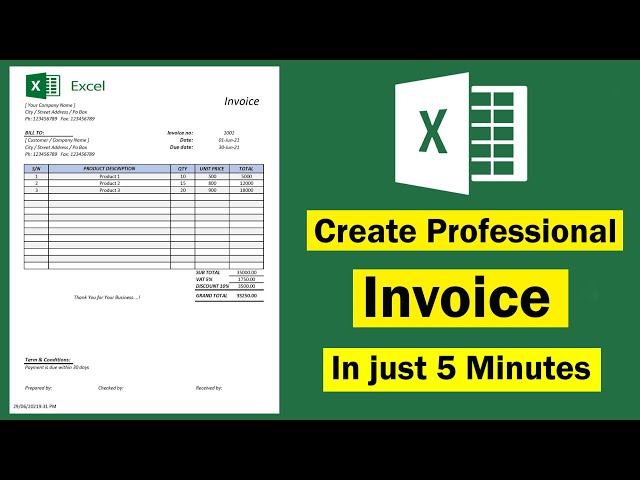

Master Sales Invoicing with Excel: Templates, Tips, and Best Practices

Master Sales Invoicing with Excel: Templates, Tips, and Best Practices - There are a lot of affordable templates out there, but it can be easy to feel like a lot of the best cost a amount of money, require best special design template. Making the best template format choice is way to your template success. And if at this time you are looking for information and ideas regarding the Master Sales Invoicing with Excel: Templates, Tips, and Best Practices then, you are in the perfect place. Get this Master Sales Invoicing with Excel: Templates, Tips, and Best Practices for free here. We hope this post Master Sales Invoicing with Excel: Templates, Tips, and Best Practices inspired you and help you what you are looking for.

A sales invoice format is a standardized template used to document and track financial transactions involving the sale of goods or services. It serves as a formal request for payment from the seller to the buyer. For instance, when a business sells products to a customer, they typically issue a sales invoice that includes details of the purchased items, quantity, unit price, total amount, payment terms, and other relevant information.

Sales invoice formats are crucial for maintaining accurate financial records, ensuring timely payments, and streamlining business processes. They provide a clear understanding of what has been sold, when it was sold, and the amount owed. Historically, sales invoices were handwritten or typed documents, but with the advent of technology, electronic invoicing has become increasingly common, offering advantages such as faster processing, reduced errors, and improved security.

This article delves into the essential elements of a sales invoice format, its importance and benefits, and best practices for creating effective and compliant invoices. Understanding these aspects can help businesses optimize their invoicing processes, improve cash flow management, and strengthen customer relationships.

Sales Invoice Format

Understanding the essential aspects of sales invoice formats is crucial for businesses to streamline their invoicing processes, ensure timely payments, and maintain accurate financial records.

- Document Type: Standardized template for recording sales transactions

- Essential Data: Includes details like invoice number, date, seller and buyer information, itemized products or services, quantities, unit prices, and total amount

- Payment Terms: Outlines the conditions for payment, including due date, accepted payment methods, and any discounts or penalties

- Legal Compliance: Conforms to regulatory requirements for invoicing, ensuring validity and enforceability

- Accuracy and Clarity: Provides a clear and concise summary of the transaction, minimizing errors and disputes

- Branding and Professionalism: Reflects the business’s brand identity and conveys a professional image

- Process Efficiency: Streamlines invoicing tasks, reducing manual effort and saving time

- Automation Compatibility: Can be easily integrated with accounting and invoicing software for automated processing

- Audit Trail: Serves as a reliable record for financial audits and compliance checks

These aspects collectively contribute to the effectiveness and efficiency of sales invoice formats. By adhering to best practices and incorporating these elements, businesses can improve their cash flow management, strengthen customer relationships, and ensure the smooth operation of their financial processes.

Document Type

Within the context of sales invoice formats, the standardized template for recording sales transactions plays a critical role in ensuring accuracy, consistency, and efficiency in documenting financial transactions. This template serves as a predefined structure that guides the recording of essential data related to a sales transaction, including invoice number, date, seller and buyer information, itemized products or services, quantities, unit prices, and total amount. By adhering to a standardized format, businesses can streamline their invoicing processes, minimize errors, and facilitate seamless data processing.

Consider a real-life example: When a business issues a sales invoice to a customer, the standardized template ensures that all necessary information is captured in a structured manner. This includes details such as the unique invoice number for identification and tracking, the date of the transaction for chronological ordering, and the contact information of both the seller and the buyer for clear communication. Additionally, the template mandates the inclusion of line items for each product or service sold, along with their respective quantities and unit prices, allowing for accurate calculation of the total amount due.

The practical significance of understanding the connection between document type and sales invoice format lies in its impact on various aspects of business operations. Firstly, it promotes data integrity by ensuring that all relevant information is consistently recorded, reducing the risk of errors and omissions. Secondly, it enhances process efficiency by enabling the automation of invoice generation and data entry tasks, saving time and resources. Thirdly, it facilitates better organization and retrieval of sales records, supporting efficient financial management and reporting.

In summary, the standardized template for recording sales transactions is a fundamental component of sales invoice formats, providing a structured framework for capturing essential data accurately and consistently. Its adoption leads to improved data integrity, enhanced process efficiency, and better organization of financial records, ultimately contributing to the smooth operation of business processes and informed decision-making.

Essential Data

Within the context of sales invoice formats, the inclusion of essential data plays a critical role in ensuring the accuracy, validity, and enforceability of financial transactions. Essential data refers to the comprehensive set of information that must be present on a sales invoice to meet legal requirements and provide a clear record of the transaction. This data includes details such as invoice number, date, seller and buyer information, itemized products or services, quantities, unit prices, and total amount.

The connection between essential data and sales invoice format is evident in the fact that the presence of this data is a defining characteristic of a valid sales invoice. Without these essential elements, the invoice may be considered incomplete or invalid, potentially leading to disputes, payment delays, or legal complications. The standardized format of a sales invoice ensures that all necessary information is captured and presented in a consistent manner, facilitating efficient processing and reducing the risk of errors.

Real-life examples of essential data within sales invoice formats can be found in various industries and business transactions. When a customer purchases goods or services from a company, the sales invoice issued will typically include the invoice number for unique identification, the date of the transaction for chronological ordering, and the contact information of both the seller and the buyer for clear communication. Additionally, the invoice will list the itemized products or services sold, along with their respective quantities and unit prices, allowing for accurate calculation of the total amount due.

The practical significance of understanding the connection between essential data and sales invoice format lies in its impact on various aspects of business operations. Firstly, it promotes transparency and accountability by providing a clear and comprehensive record of the transaction, reducing the risk of disputes and misunderstandings. Secondly, it facilitates efficient payment processing by ensuring that all necessary information is readily available to the payer, expediting the settlement of accounts receivable. Thirdly, it supports legal compliance by adhering to regulatory requirements for invoicing, minimizing the risk of penalties or legal challenges.

In summary, the essential data included in sales invoice formats serves as the foundation for accurate, valid, and enforceable financial transactions. Its presence is a critical component of a well-structured sales invoice and has significant implications for transparency, accountability, efficient payment processing, and legal compliance. Understanding this connection empowers businesses to create effective and compliant invoices that facilitate smooth business operations and strengthen customer relationships.

Payment Terms

Within the context of sales invoice formats, payment terms play a critical role in defining the conditions under which payment is expected from the buyer. These terms outline the due date for payment, the accepted payment methods, and any applicable discounts or penalties. The connection between payment terms and sales invoice format is evident in the fact that these terms are an essential component of a comprehensive sales invoice.

Payment terms are considered a critical component of sales invoice formats because they directly impact cash flow management and customer satisfaction. Clear and well-defined payment terms ensure that businesses receive payment promptly, reducing the risk of late payments and improving overall financial stability. Additionally, flexible payment terms can enhance customer satisfaction by providing options that align with their financial capabilities.

Real-life examples of payment terms within sales invoice formats can be found in various industries and business transactions. When a customer purchases goods or services from a company, the sales invoice issued will typically include the due date for payment, which is the date by which the payment is expected to be received. The invoice will also specify the accepted payment methods, such as bank transfer, credit card, or check, providing the customer with convenient options to settle their account. Furthermore, some businesses offer discounts for early payments as an incentive for customers to pay promptly, while others may impose penalties for late payments to discourage tardiness.

The practical significance of understanding the connection between payment terms and sales invoice format lies in its impact on various aspects of business operations. Firstly, it promotes financial planning and budgeting by providing businesses with a clear understanding of when payments are due and what methods are acceptable. Secondly, it facilitates efficient cash flow management by ensuring that businesses have a predictable inflow of funds, reducing the risk of cash shortages. Thirdly, it strengthens customer relationships by establishing clear expectations and providing flexibility in payment options.

In summary, payment terms are an essential component of sales invoice formats, outlining the conditions for payment and directly impacting cash flow management and customer satisfaction. Understanding this connection empowers businesses to create effective and compliant sales invoices that facilitate smooth business operations and strengthen customer relationships.

Legal Compliance

Within the context of sales invoice formats, legal compliance plays a crucial role in ensuring the validity and enforceability of financial transactions. Legal compliance refers to the adherence to regulatory requirements and standards that govern the issuance and processing of sales invoices. The connection between legal compliance and sales invoice format is evident in the fact that invoices must conform to these requirements to be considered legally binding and enforceable in a court of law.

Legal compliance is a critical component of sales invoice formats because it provides a framework for businesses to create invoices that are accurate, transparent, and consistent with industry standards. Failure to comply with legal requirements can lead to disputes, payment delays, legal challenges, and reputational damage. Real-life examples of legal compliance within sales invoice formats include adhering to regulations on invoice numbering and sequencing, providing clear and concise descriptions of products or services sold, and including all required tax information. By adhering to these requirements, businesses can ensure that their invoices are legally compliant and will be accepted by customers and recognized by tax authorities.

The practical significance of understanding the connection between legal compliance and sales invoice format lies in its impact on various aspects of business operations. Firstly, it promotes ethical and transparent business practices by ensuring that invoices accurately reflect the terms of the transaction and comply with applicable laws and regulations. Secondly, it strengthens the legal standing of businesses in the event of disputes or payment disagreements, as legally compliant invoices are more likely to be upheld in court. Thirdly, it simplifies the process of tax compliance by providing a standardized format for reporting sales and tax information, reducing the risk of errors and penalties.

In summary, legal compliance is an essential component of sales invoice formats, ensuring the validity and enforceability of financial transactions. Understanding this connection empowers businesses to create compliant invoices that facilitate smooth business operations, protect their legal interests, and maintain a positive reputation.

Accuracy and Clarity

Within the context of sales invoice formats, accuracy and clarity play a crucial role in minimizing errors, disputes, and misunderstandings. Accuracy refers to the correctness and completeness of the information presented on the invoice, while clarity pertains to the ease with which the invoice can be understood and interpreted. The connection between accuracy and clarity, and sales invoice format is evident in the fact that invoices serve as the primary record of financial transactions and must accurately reflect the terms of the agreement between the seller and the buyer.

Accuracy and clarity are critical components of sales invoice formats because they directly impact the efficiency of business processes and customer satisfaction. Accurate and clear invoices reduce the risk of errors in data entry, payment processing, and financial reporting. They also facilitate efficient communication between the seller and the buyer, minimizing the likelihood of disputes or misunderstandings. Real-life examples of accuracy and clarity within sales invoice formats include providing detailed descriptions of products or services sold, using clear and concise language, and ensuring that all essential data, such as quantities, unit prices, and tax information, is correctly presented.

The practical significance of understanding the connection between accuracy, clarity, and sales invoice format lies in its impact on various aspects of business operations. Firstly, it promotes transparency and accountability by providing a clear and verifiable record of the transaction, reducing the risk of fraud or manipulation. Secondly, it streamlines accounting and payment processes by ensuring that all necessary information is readily available and easily processed. Thirdly, it strengthens customer relationships by building trust and confidence through the provision of accurate and easy-to-understand invoices.

In summary, accuracy and clarity are essential components of sales invoice formats, playing a vital role in minimizing errors, disputes, and misunderstandings. Understanding this connection empowers businesses to create effective and compliant invoices that facilitate smooth business operations, strengthen customer relationships, and contribute to the overall efficiency and accuracy of financial processes.

Branding and Professionalism

Within the context of sales invoice formats, branding and professionalism play a critical role in shaping the perception of a business and its products or services. Branding refers to the unique identity and image that a business cultivates through its logo, colors, typography, and overall presentation. Professionalism, on the other hand, encompasses the level of care, attention to detail, and adherence to industry standards that are reflected in a business’s interactions with customers.

The connection between branding and professionalism, and sales invoice format is evident in the fact that invoices serve as a representation of the business to its customers. A well-designed and professionally presented invoice can enhance brand recognition, convey a sense of trust and credibility, and contribute to a positive customer experience. Conversely, an invoice that lacks branding and professionalism may damage a business’s reputation and make customers question the quality of its products or services.

Real-life examples of branding and professionalism within sales invoice formats include the use of a consistent brand logo and color scheme, clear and concise language, and attention to detail in the presentation of the invoice. Some businesses also include additional elements, such as a brief thank-you note or a promotional offer, to enhance the customer experience and foster goodwill.

The practical significance of understanding the connection between branding, professionalism, and sales invoice format lies in its impact on various aspects of business operations. Firstly, it promotes brand awareness and recognition by reinforcing the business’s unique identity through every invoice that is issued. Secondly, it enhances customer trust and credibility by conveying a sense of professionalism and attention to detail. Thirdly, it contributes to a positive customer experience by making invoices easy to understand and visually appealing.

In summary, branding and professionalism are essential components of sales invoice formats, playing a vital role in shaping the perception of a business and its products or services. Understanding this connection empowers businesses to create effective and compliant invoices that not only meet legal requirements but also contribute to brand building, customer satisfaction, and overall business success.

Process Efficiency

Within the context of sales invoice formats, process efficiency plays a crucial role in streamlining invoicing tasks, reducing manual effort, and saving valuable time. Process efficiency refers to the optimization of invoicing workflows and procedures to enhance productivity and minimize errors. The connection between process efficiency and sales invoice format is evident in the fact that a well-structured and standardized invoice format enables efficient data entry, processing, and management.

Process efficiency is a critical component of sales invoice formats because it directly impacts the time and resources required to complete invoicing tasks. Manual processes, such as handwritten invoices or data entry into multiple systems, can be time-consuming and error-prone. By adopting a standardized invoice format, businesses can automate many aspects of the invoicing process, such as data population, calculations, and document generation. This automation reduces the need for manual data entry, minimizes errors, and significantly speeds up the invoicing cycle.

Real-life examples of process efficiency within sales invoice formats include the use of pre-populated templates, automated calculations, and electronic invoicing systems. Pre-populated templates eliminate the need to manually enter repetitive information, such as company details and product descriptions. Automated calculations ensure accuracy and consistency in invoice totals and tax calculations. Electronic invoicing systems further streamline the process by allowing businesses to send and receive invoices electronically, eliminating the need for printing, mailing, and manual data entry.

The practical significance of understanding the connection between process efficiency and sales invoice format lies in its impact on various aspects of business operations. Firstly, it reduces labor costs by minimizing the time and effort required for invoicing tasks. Secondly, it improves accuracy by reducing the risk of errors associated with manual data entry. Thirdly, it enhances cash flow by accelerating the invoice-to-payment cycle. Lastly, it provides businesses with more time to focus on other value-added activities, such as sales and customer service.

Automation Compatibility

Within the context of Sales Invoice Format, automation compatibility plays a vital role in streamlining invoicing processes and enhancing overall efficiency. Automation compatibility refers to the ability of a sales invoice format to seamlessly integrate with accounting and invoicing software, enabling automated processing of invoices and eliminating the need for manual data entry and repetitive tasks.

-

Data Import and Export

Automated invoice formats allow for seamless import and export of invoice data to and from accounting and invoicing software. This eliminates the need for manual data entry, reducing the risk of errors and saving valuable time.

-

Automated Calculations

Integration with accounting software enables automated calculations of invoice totals, taxes, and discounts. This ensures accuracy and consistency in invoice calculations, reducing the risk of oversights or errors.

-

Electronic Invoicing

Automation compatibility facilitates electronic invoicing, allowing businesses to send and receive invoices electronically. This eliminates the need for printing, mailing, and manual data entry, significantly speeding up the invoice-to-payment cycle.

-

Real-Time Updates

Integrated invoice formats provide real-time updates to accounting systems, ensuring that financial records are always up-to-date. This enables better cash flow management and timely decision-making.

By leveraging automation compatibility, businesses can streamline their invoicing processes, reduce manual effort, improve accuracy, and gain valuable time. Moreover, integration with accounting software provides a comprehensive view of financial data, enabling better financial planning and decision-making. Ultimately, automation compatibility enhances the overall efficiency and effectiveness of Sales Invoice Formats, contributing to the smooth operation of business processes and improved financial management.

Audit Trail

Within the context of Sales Invoice Format, the aspect of “Audit Trail: Serves as a reliable record for financial audits and compliance checks” holds significant importance. An audit trail refers to the chronological and auditable record of all transactions and activities related to a sales invoice. Its purpose is to provide a clear and verifiable account of the invoicing process, ensuring the accuracy and validity of financial records for both internal and external scrutiny.

-

Transaction History

Sales invoices serve as a comprehensive record of all transactions, including the date, invoice number, customer details, itemized products or services, quantities, unit prices, and total amount. This detailed history allows auditors to trace and verify each transaction, ensuring the accuracy and completeness of financial records.

-

Compliance Documentation

Sales invoices also provide essential documentation for compliance purposes. They contain information such as tax calculations, payment terms, and any applicable discounts or surcharges. This documentation helps businesses meet their legal and regulatory obligations, reducing the risk of penalties or disputes.

-

Fraud Prevention

A well-maintained audit trail can help prevent fraud by providing a clear record of all transactions. Auditors can use this trail to identify any unauthorized changes or discrepancies, ensuring the integrity of financial data and protecting businesses from financial losses.

-

Improved Efficiency

An organized and easily accessible audit trail streamlines the audit process, saving time and resources. Auditors can quickly retrieve and analyze relevant information, reducing the duration and cost of audits. This efficiency enables businesses to allocate resources more effectively and focus on core business operations.

In conclusion, the “Audit Trail: Serves as a reliable record for financial audits and compliance checks” aspect of Sales Invoice Format is crucial for maintaining accurate and verifiable financial records. It provides a comprehensive history of transactions, supports compliance efforts, helps prevent fraud, and improves audit efficiency. By ensuring the integrity and transparency of sales invoices, businesses strengthen their financial controls, enhance their credibility, and mitigate potential risks.

Frequently Asked Questions about Sales Invoice Format

This section addresses common questions and clarifications regarding the essential aspects and best practices of Sales Invoice Formats.

Question 1: What are the essential elements of a Sales Invoice Format?

A Sales Invoice Format typically includes an invoice number, date, seller and buyer information, itemized products or services, quantities, unit prices, total amount, payment terms, and any applicable taxes or discounts.

Question 2: Why is it important to use a standardized Sales Invoice Format?

A standardized format ensures consistency, accuracy, and completeness of invoice data. It facilitates efficient processing, minimizes errors, and enhances legal compliance.

Question 3: What are the benefits of electronic invoicing?

Electronic invoicing offers advantages such as faster processing, reduced costs, improved accuracy, enhanced security, and better environmental sustainability.

Question 4: How can I create an effective Sales Invoice Format for my business?

Consider industry best practices, legal requirements, branding guidelines, and the needs of your customers. Keep the format clear, concise, and easy to understand.

Question 5: What should I do if I make a mistake on a Sales Invoice?

If an error is discovered, issue a corrected invoice promptly. Clearly indicate the changes and provide an explanation for the correction.

Question 6: How can I ensure the accuracy of my Sales Invoices?

Implement thorough verification procedures, including checking calculations, reviewing product descriptions, and confirming customer information.

Question 7: What are the key considerations for maintaining an audit trail for Sales Invoices?

Maintain a chronological record of all invoices, including any revisions or adjustments. Ensure that the audit trail is secure, accessible, and provides a clear history of transactions.

These FAQs provide a concise overview of the essential aspects of Sales Invoice Formats. Understanding and adhering to best practices can enhance the efficiency, accuracy, and compliance of your invoicing processes, contributing to the smooth operation of your business.

In the next section, we will explore advanced techniques for optimizing Sales Invoice Formats, including automation, integration with accounting systems, and strategies for improving cash flow.

Tips for Optimizing Sales Invoice Formats

This section provides actionable tips to enhance the efficiency, accuracy, and compliance of your Sales Invoice Formats, contributing to streamlined business processes and improved financial management.

Tip 1: Leverage Electronic Invoicing

Embrace electronic invoicing to streamline processes, reduce costs, and improve accuracy. Consider integrating with accounting software for automated processing and real-time updates.

Tip 2: Ensure Data Accuracy

Implement thorough verification procedures to minimize errors. Check calculations, review product descriptions, and confirm customer information before finalizing invoices.

Tip 3: Maintain a Clear Audit Trail

Establish a chronological record of all invoices, including any revisions or adjustments. Ensure the audit trail is secure, accessible, and provides a clear history of transactions.

Tip 4: Utilize Automation Tools

Automate invoice generation, calculations, and data entry tasks to save time and reduce manual effort. Explore invoice software or accounting integrations for seamless processing.

Tip 5: Optimize for Mobile Accessibility

Ensure your invoice format is mobile-friendly, allowing customers to view and pay invoices easily on their smartphones or tablets.

Tip 6: Customize for Your Business

Tailor your invoice format to reflect your branding and include relevant information for your customers. Consider adding payment instructions, special notes, or promotional offers.

Tip 7: Seek Professional Advice

Consult with an accountant or financial advisor to ensure compliance with legal and regulatory requirements and optimize your invoice formats for tax purposes.

Tip 8: Provide Clear Payment Instructions

Include precise payment instructions, such as accepted payment methods, due dates, and any applicable discounts or penalties, to facilitate timely payments.

Tip 9: Offer Multiple Payment Options

Provide customers with various payment options, such as online payments, bank transfers, or credit card processing, to enhance convenience and improve cash flow.

Tip 10: Review and Update Regularly

Periodically review and update your Sales Invoice Format to ensure it aligns with changing business needs, legal requirements, and industry best practices.

By implementing these tips, you can optimize your Sales Invoice Formats, enhance the efficiency and accuracy of your invoicing processes, and improve your overall financial management.

In the next section, we will discuss advanced strategies for maximizing cash flow and leveraging Sales Invoice Formats to improve customer relationships.

Conclusion

This article has delved into the essential elements, best practices, and optimization techniques of Sales Invoice Formats. By adhering to standardized formats and leveraging electronic invoicing, businesses can streamline their invoicing processes, ensure accuracy, and improve compliance. Optimization strategies, such as automation and mobile accessibility, further enhance efficiency and customer convenience.

Key takeaways include the significance of a clear audit trail for financial accountability, the benefits of customizing invoice formats to reflect business branding, and the importance of providing multiple payment options to improve cash flow. These interconnected elements collectively contribute to effective and compliant invoicing practices.

Master Sales Invoicing with Excel: Templates, Tips, and Best Practices was posted in April 7, 2024 at 3:09 am. If you wanna have it as yours, please click the Pictures and you will go to click right mouse then Save Image As and Click Save and download the Master Sales Invoicing with Excel: Templates, Tips, and Best Practices Picture.. Don’t forget to share this picture with others via Facebook, Twitter, Pinterest or other social medias! we do hope you'll get inspired by ExcelKayra... Thanks again! If you have any DMCA issues on this post, please contact us!